I knew Walmart calls itself the home of one-stop shopping.

What I didn’t know is the major retailer and other big box stores have now

adding another branch to their repertoire of serves: banking.

Photo Credit: http://i.imgur.com/I5oNu.jpg

Of 618 US consumers poled in September, one in three would

consider a mortgage

from Walmart while one in two would consider obtaining one from PayPal. The

store has yet to offer mortgages but it does provide small business loans at

its Sam’s Club stores.

Rewind several

years to the onset of the 2007/2008 economic crisis. Since then banks have

limited the accessibility and availability of credit, especially that for new

lenders with no credit history or those will poor credit ratings. Moreover,

people have lost much of their faith in the big banks to be responsible

lenders. In rural areas where the number of banks is already few and far

between, the somehow omnipresent businesses (ie Walmart, Sam’s Club, Costco,

Home Depot, etc) realized they could fill the void by providing ATMs for check

deposits and cash withdrawals, life insurance policies, and handing out loans

for various individual ventures.

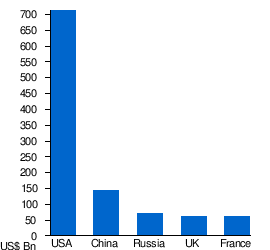

Walmart is the world's biggest retailer and the biggest company in terms of the number of its employees. It's a natural tendency of a company to look for an uncharted niche when expanding its services. Approximately eight cents of every dollar spent in the US stores is spent at Walmart.

Photo credit: http://www.onlinemarketing-trends.com/2011/02/size-of-walmart-statistics-and-trends.html#sthash.Qp153lp2.dpbs

In communities

with little or no access to a local bank, such banking functions provide locals

with the opportunity to access loans and funds in their own “neighborhood.”

People who may not have such access, whether they not be approved by the banks

to receive a loan or not reside close enough to one to go, can now get

financial assistance. The problem however is that these transactions are not

regulated by the same standards and rules that govern the practices of regular

banks. Even the prepaid cards are not backed by the FDIC. Furthermore, the

consumers’ long-term interests are not the concerns of Walmart, et al. For such

stores banking is a business venture intended to put more money into customers’

hands, which they then turn back to the stores at the cash register. It’s not

about them saving for retirement or for college; it’s “how else can I get them

to buy more?”

I see the

benefit of enabling more small business and homeowners to make investments. But

I don’t trust that the big box stores can be any more responsible than the banks.

Risky loans are still risky, no matter who doles out the original funds and how

high interest climbs. I also worry about such important financial transactions

taking place outside of federal oversight. Even though the fed dropped the ball

on preventing a housing boom and bust under Barney Frank, I still think that

federal oversight is necessary to protect the individuals as well as the

taxpayers. No way I will EVER bail out Walmart.